The debit card is a powerful link between your bank and your customers. Customers carry with them the card your bank issued everywhere they go to make purchases on everyday items.

These purchases generate interchange income for the card-issuing banks. But that’s not the whole story. Interchange income and expenses vary depending on the card networks and payment processors. As debit card usage continues to grow, any improvements in net interchange rates or reductions in processing expenses can result in a better-performing and more profitable debit card program.

What is Interchange?

Interchange is the small percentage of each debit card purchase amount paid to financial institutions by merchants to compensate card-issuing financial institutions for the costs of facilitating transactions.

Interchange rates may be fixed, variable, or a combination of the two. In some instances, they also include a cap rate. These rates are based upon various factors, such as the purchase category, the type of transaction authorized, the type of card presented, or, if the purchase was made online, card-not-present.

The Durbin Amendment specifies that debit card issuers must enable at least two unaffiliated payment networks for processing electronic debit transactions. This means anytime your cardholder uses their debit card to buy something, the merchant (and its acquirer processor) chooses which network the transaction travels over, typically based on the lowest merchant cost. This choice has consequences for community banks, as the gross and net interchange rates earned can vary wildly with some networks.

Maximizing Net Interchange Income

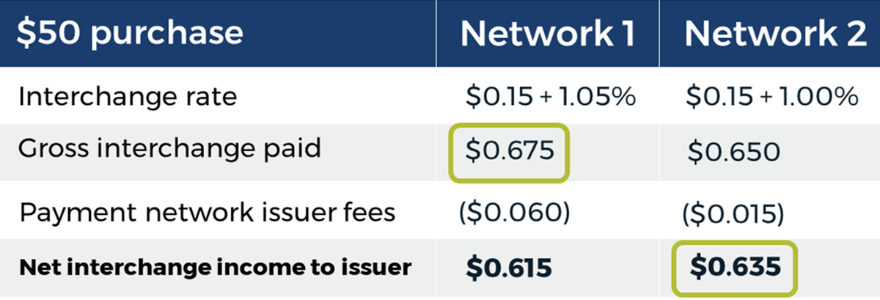

All networks couple differently due to acquirer/merchant routing choice favoritism or their desire to help earn top rates for the financial institution. In this example, a cardholder makes a $50 purchase. The fixed fee is $0.15 for both networks, and the variable rate is 1.05% for Network 1 and 1.00% for Network 2. This results in Network 1 having a gross interchange of $0.025 higher than Network 2.

The next piece of the story is about the network fees you’ll be charged. Once we know this, we can figure out your net interchange. Network 1 has an issuer fee of $0.06, while Network 2 has an issuer fee of $0.015. Once these fees are taken into consideration, as a financial institution, you would want the transaction to route on Network 2, as that network provides you with greater net interchange.

Minimizing Processing Costs and Fraud Losses

Lowering operational costs and reducing fraud losses provides a boost to your debit card program’s bottom line. EFT providers who process your debit card transactions can help lower your operational costs by reducing your issuer switch fees. Some processors, who own their network, will also waive the processing fee when a single-message transaction is routed through their network.

Another cost is fraud. On average, banks lose a little over $100 per fraud claim, with 80% of those losses being related to card-not-present transactions. This means investing in fraud tools is a must. And it takes more than a one-size-fits-all approach. It’s crucial for banks to have a layered approach to security and fraud prevention.

Banks can implement fraud management solutions to recognize patterns and predict trends using artificial intelligence to detect and stop fraud. They can also rely on dispute management experts to professionally handle cardholder calls, conduct investigations and properly document claims to keep customers happy and ensure regulatory compliance. Card control functions allow customers to access their card information, receive fraud alerts and pause their card if the card is lost or stolen.

Banks should also engage and educate their customers about fraud. Educational materials, such as newsletters, blogs, social media posts and marketing materials raise awareness about common fraud schemes and best practices for online banking security. All of these tools reduce fraud losses while increasing customer loyalty, giving customers more confidence knowing their bank is helping them protect their debit cards.

Picking a Debit Card Partner

The payments industry is constantly changing. This means partnering with a debit network and processor that has your best interest in mind, which is as important as ever. Let SHAZAM® review your debit card program to ensure your community bank is making the most net interchange from each cardholder transaction. If you don’t get a comprehensive evaluation of your debit network and processor, you may be leaving money on the table.

Matt Morrow is a regional director of sales — EFT for the state of Colorado. If you want a competitive evaluation of your debit card program, contact him at mmorrow@shazam.net.

SHAZAM is proud to be an associate member of the Independent Community Bankers of Colorado. SHAZAM is the only nationwide independent, member-owned debit network, processor and core provider supporting community banks. Our independent, member-owned structure allows financial institutions to participate in shaping the products and services SHAZAM provides to our partners.