Our experts cover the top headlines each quarter to keep you apprised of regulatory compliance matters impacting community financial institutions. This quarter, we highlight several proposed rulemakings and other supervisory guidance to help navigate the current regulatory environment.

Accuracy Problems in the Credit Reporting System

The Consumer Financial Protection Bureau (CFPB) issued an edition of Supervisory Highlights on April 8, 2024, that shared findings related to accuracy problems in the credit reporting system. The bureau found the following issues during recent examinations:

- Consumer reporting companies failed to block or remove information related to identity theft and human trafficking.

- Consumer reporting companies accepted information from unreliable furnishers.

- Furnishers provided information to consumer reporting companies they knew was false.

- Furnishers didn’t follow requirements to dispute investigations and identity theft.

The consumer reporting companies and furnishers involved are taking corrective actions in response to the CFPB’s findings.

Actions to Combat Junk Fees Charged by Mortgage Servicers

The CFPB issued an edition of Supervisory Highlights on April 24, 2024, that shared recent examination findings regarding mortgage servicers. The bureau highlighted the following actions by mortgage servicers:

- Charging illegal junk fees to consumers.

- Sending deceptive notices to homeowners.

- Violating loss mitigation rules that are designed to help struggling borrowers stay in their homes.

- Missing deadlines to pay property tax and home insurance.

The mortgage servicers involved are taking corrective actions, including changes to their policies and procedures. Refunds and remediations are being provided to homeowners for fee-related findings.

Third-Party Risk Management Practices

The Federal Reserve System, Federal Deposit Insurance Corporation (FDIC) and Office of the Comptroller of the Currency (OCC) collectively issued the “Interagency Guidance on Third-Party Relationships: Risk Management” (TPRM Guidance) on May 3, 2024. This guide supports community banks in managing risks presented by third-party relationships.

Incentive-Based Compensation

The FDIC, OCC and FHFA have adopted a Notice of Proposed Rulemaking to address incentive-based compensation arrangements as required under Section 956 of the Dodd-Frank Act. The NCUA is also expected to take action on the Notice of Proposed Rulemaking in the near future. The proposed rule will apply to institutions with $1 billion or more in assets. The proposed rule includes a prohibition on incentive-based compensation arrangements that don’t include a risk adjustment of awards, deferral of payments, and forfeiture and clawback provisions. There will also be an emphasis on the role of sound governance and risk management control mechanisms.

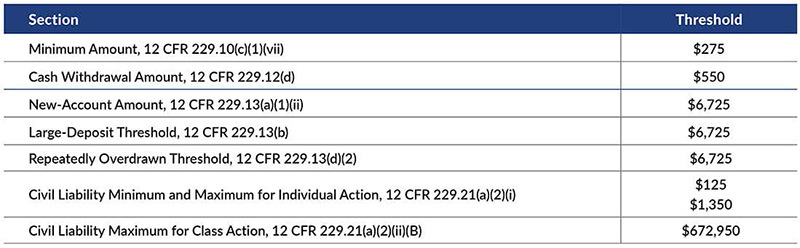

Availability of Funds and Collection of Checks Threshold Adjustments

The CFPB and the Federal Reserve Board (FRB) jointly adjusted for inflation dollar amounts relating to the availability of customer funds. These changes in Regulation CC include the minimum amount of deposited funds that banks must make available for withdrawal by opening of business on the next day for certain check deposits as well as the amount of funds deposited by certain checks in a new account that are subject to next-day availability. The following thresholds are effective from July 1, 2025, for five years:

Section 1071 of the Dodd-Frank Act

The CFPB announced new deadlines for compliance with Section 1071 on May 17, 2024. This section amends the Equal Credit Opportunity Act (ECOA) to require financial institutions to compile, maintain and submit to the CFPB data on applications for credit for women-owned, minority-owned and small businesses. Compliance deadlines have been updated as follows:

Consumer Financial Protection Circular 2024-03

The CFPB issued a circular on June 4, 2024, to emphasize that covered persons who include unlawful or unenforceable terms in their consumer contracts may violate the CFPA’s prohibition on deceptive acts or practices. The circular highlights that the inclusion of certain terms in contracts for consumer financial products or services may violate the prohibition when applicable federal or state law renders such contractual terms, including those that purport to waive consumer rights, unlawful or unenforceable.

Recognizing Open Banking Standards

On June 5, 2024, the CFPB finalized a rule establishing the qualifications for recognized industry standard-setting bodies, essential for implementing the forthcoming Personal Financial Data Rights Rule. The rule outlines the necessary attributes for recognition, such as openness, transparency, balanced decision-making, consensus and due process, and provides a guide for standard setters to apply for CFPB recognition. This move aims to prevent dominant firms from manipulating standards and to promote competition, facilitating a transition toward open banking.

Revised Comptroller’s Handbook Booklet and Rescissions

The OCC issued version 2.0 of the “Retail Nondeposit Investment Products” booklet of the Comptroller’s Handbook on June 11, 2024. This booklet discusses risks and risk management practices associated with the recommendation or sale of nondeposit investment products to retail customers and provides a framework for evaluating a bank’s retail nondeposit investment product program.

FCRA Medical Debt Rulemaking

On June 11, 2024, the CFPB began accepting public comment on a proposed rule amending Regulation V, which implements the Fair Credit Reporting Act (FCRA), concerning medical information. The CFPB is proposing to remove a regulatory exception in Regulation V from the limitation in the FCRA on creditors obtaining or using information on medical debts for credit eligibility determinations.

New Protections for Payday and Installment Loans

The CFPB issued a rule in 2017 to address lenders’ unfair and abusive collection practices. The CFPB found that even after a borrower’s account had been shown to be empty, payday and installment loan lenders would continue attempting to withdraw money from the account to pay off the loan. Under the rule, after two attempts to withdraw funds from an account have failed, covered lenders can’t try again unless the borrower specifically authorizes another attempt. The rule was to take effect in 2019 but has been delayed in the courts. An existing court order pausing the rule is set to expire 286 days after the Supreme Court enters judgment, which was expected on June 17. As a result, the rule will go into effect on March 30, 2025.

2024 Guide to HMDA Reporting

On June 17, 2024, the OCC issued the Federal Financial Institutions Examination Council’s (FFIEC) revised 2024 guide, “A Guide to HMDA Reporting: Getting it Right!” The 2024 guide provides banks with resources to comply with the Home Mortgage Disclosure Act and Regulation C.

CFPB Issues Fair Lending Report

The CFPB issued its Fair Lending Annual Report to Congress on June 26, 2024. The report describes how the bureau took action against unlawful discrimination and advanced access to credit during 2023.

Proposed Rule To Strengthen and Modernize AML/CFT Programs

On June 28, 2024, FinCEN issued a proposed rule to strengthen and modernize AML/CFT programs. This rule would enable financial institutions to focus their resources and attention in a manner consistent with their risk profiles. This proposed rule would:

- Amend the existing program rules to explicitly require financial institutions to establish, implement and maintain effective, risk-based and reasonably designed AML/CFT programs with certain minimum components, including a mandatory risk assessment process.

- Require financial institutions to review governmentwide AML/CFT priorities and incorporate them, as appropriate, into risk-based programs, as well as provide for certain technical changes to program requirements.

- Promote clarity and consistency across FinCEN’s program rules for different types of financial institutions.

Mortgage Servicing During the COVID-19 Pandemic

On June 28, 2024, the CFPB released a report on the experiences of distressed mortgage borrowers trying to access loss mitigation programs during the COVID-19 pandemic. The report highlights the following findings:

- Distressed respondents reported that they didn’t know how or where to apply for loss mitigation programs and the application process was too cumbersome.

- Over 20% of respondents reported speaking a language other than English at home; the survey reflects a prevalence of borrowers with limited English proficiency.

- Among distressed respondents who received forbearance, more than one-third were unclear about what would happen at the end of the forbearance period and how to repay suspended payments.

Quality Control Standards for Automated Valuation Models

In June 2024, the OCC, FDIC and CFPB approved a final rule to implement quality control standards for automated valuation models used to estimate the value of a home. The rule is to be jointly issued by the OCC, Federal Reserve Board of Governors, FDIC, NCUA, CFPB and FHFA and will take effect 12 months after publication in the federal register. The rule applies to mortgage originators and secondary market issuers who use automated valuation methods (AVMs) and requires quality control standards designed to:

- Ensure a high level of confidence in the estimated property valuations.

- Safeguard against the manipulation of data.

- Avoid conflicts of interest.

- Require random sample testing and reviews of AVM valuations.

- Comply with applicable nondiscrimination laws.