As yields continue to set cyclical highs during 2023, many community bankers have asked me questions about what their next best purchase should be. Some of them have been surprised to hear an answer that I’ve been giving for the better part of this decade, even though absolute yields and the shape of the curve look nothing like, say, 2015.

Since the difference in yields between short maturities and longer ones is still upside-down (i.e., the curve is inverted), most bond analysts, economists and the Federal Reserve itself are predicting that we’ll see some economic slowdown, cooling of inflation and eventually some rate cuts. (Although to be sure, they differ greatly as to the timing.) If and when we see a normalization to the shape of the curve, a portfolio structure that would perform well is a “barbell.” This month, we review the structure and the advantages of such an exercise for your investment portfolio.

Repetition and Resistance

The barbell is simple to build and easy to evaluate later. It just requires an investor to define what it considers to be suitable short-term and long-term investments. Of course, community bankers have differing opinions on what counts as a long-term investment, but generally speaking, those with durations of five years and greater are considered to be on the high end of the price-risk scale.

Once you’ve identified the target investments, the portfolio manager will simply purchase roughly similar amounts of both and keep the weightings balanced through ongoing monitoring. By having a collection of bonds that are heavy on both ends of the maturity spectrum, you’ve successfully built a barbell.

Classic Structure

Among the bonds that meet community banks’ criteria of liquidity and credit quality are those issued by the Small Business Administration (SBA). They are direct obligations of Uncle Sam, and new issue volumes continue to set records, so the SBA market continues to broaden and deepen. Two of the more visible products are 7(a) pools, which are true floating rate instruments, and Development Company Participation Certificates (DCPCs), which are fixed rate pools with long average lives.

It makes logistical sense to consider them together for a barbell. For one thing, credit quality is unsurpassed. For another, one would be hard-pressed to find two bonds with more disparate price-risk profiles. For still another, we can address the premium risk that attaches to the 7(a)s by pairing them with a DCPC that is available at a price near par. Finally, at this point in the rate cycle, both ends of the barbell yield much more than they would have a year ago, so an investor today has a big head start over 2022.

End of Cycle Projections

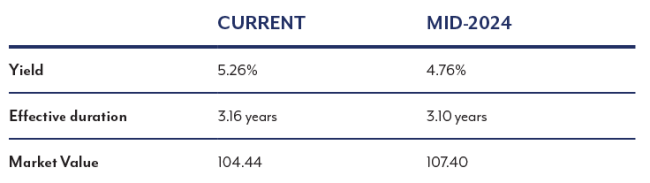

We created a hypothetical barbell portfolio by modeling equal amounts of 7(a)s and 25-year DCPCs. For the record, the actual pools are SBA 540099 at a purchase price of 108.875 and SBAP 2023-25 D 1 at 100.00. We made note of their market values and yields as of April 30, 2023, and in a 100-basis point (1.00%) lower environment over the next year. This rate-cut assumption was driven by both the fed funds futures market and the Fed’s most recent projections. (At present, market-driven expectations are calling for about five 25-basis point cuts over 12 months, while the Fed is estimating about two.)

Here are the more important average weights and measures:

Two variables could make these projections either better or worse than actual. One is that we are assuming a parallel shift downward in the yield curve. What’s more likely to happen is steepening, by virtue of short rates reacting more in step with Fed easing, and longer rates moving less in comparison; that would mean the fixed rate pool wouldn’t appreciate in price as much. The other is that DCPC’s carry a penalty for “voluntary conversions” (refinancings, for example) for 10 years that is passed through to the investor. Since we can’t assume any penalties will actually be paid, we ignore them for this projection, although the yield could be enhanced by prepayments. As it is, most of the barbell’s yield will be maintained while the duration remains unchanged, and the positions have about a 3% unrealized gain. That’s a success.

Stretch Before you Lift

As always, a word of advice from your trainer. These securities will probably produce very little cash flow in the early stages, especially if the pools are new. As they season, it’s more likely that the floaters will have faster prepayments, so you’ll need to monitor your positions to keep the fixed/floating balance in place.

So, if your bond portfolio is suffering from a lack of recent energy or isn’t built to run into the headwinds from the Fed’s monetary policy, take a trip to your favorite broker’s financial fitness center. A session in barbell lifting can help flex your community bank’s economic muscle.

Jim Reber is the President and CEO of ICBA Securities, ICBA’s institutional, fixed-income broker-dealer for community banks. He can be reached at jreber@icbasecurities.com.