Software has been pivotal in enhancing productivity in the ever-evolving banking landscape. For instance, advanced CRM systems have streamlined customer interactions, while data analytics tools have improved decision-making processes. These innovations have not only bolstered efficiency but also significantly boosted the financial performance of banks.

However, the COVID-19 pandemic underscored a crucial lesson: Productivity diminishes when connectivity is compromised. According to Gallup, in 2021, the percentage of engaged workers in the U.S. experienced its first decline in over a decade, dropping from 36% in 2020 to 34%. This decline continued into early 2022, with only 32% of employees engaged and a rise in active disengagement to 17%, up from 16% in 2021. One of the factors causing this was the ability to work from home using various technologies such as video conferencing and project management systems. While technology-enabled productivity to continue, connectivity declined.

Enter Generative AI — a technological game changer. This new wave of software transcends traditional productivity tools, emphasizing connectivity. Generative AI offers a more dynamic, interactive experience with natural language processing and machine learning capabilities than traditional business software.

A prime example is Conversational AI. This facet of Generative AI enables engagement between employees and the company through an AI Virtual Consultant. This consultant functions like an experienced human consultant, asking dynamic, context-aware questions. The benefit? Every employee can access personalized, professional-level consultation regardless of their role.

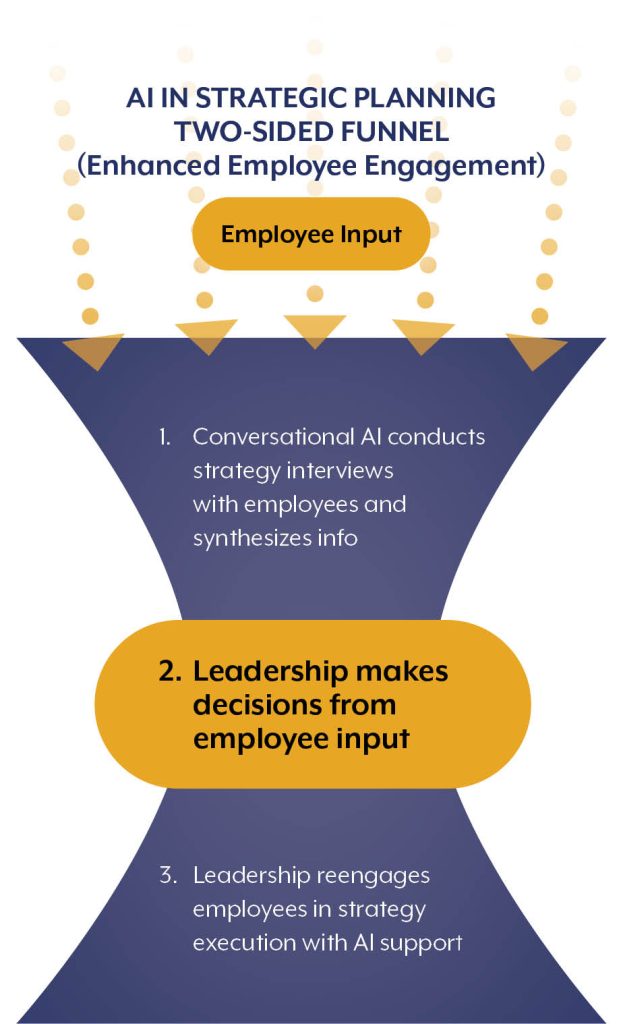

A specific use-case of Conversational AI’s ability to connect more employees to the company and each other is the process of strategic planning and execution. The chart below uses a two-sided funnel to show how Conversational AI conducts professional strategy interviews with multiple employees and synthesizes the data in minutes. This allows the leadership team to make informed decisions and engage employees in strategy execution. AI not only acts as a consultant available to everyone to generate ideas, it analyzes and synthesizes the information and supports strategy execution.

Such technology is particularly impactful in community banks. Through in-depth AI-driven interviews, banks can obtain valuable insights from their employees about current operations and future strategies. This fosters a more participatory work environment and aligns the bank’s community impact initiatives with employees’ aspirations to make a difference.

Community banks are integral to local economies, often amplifying the impact of capital through localized lending and investment. By leveraging Conversational AI, these banks can bridge the gap between individual employees’ goals and the organization’s overarching mission. Employees seeing their work contributing to meaningful community development enhances their sense of ownership, satisfaction and overall life fulfillment.

While AI is not a cure-all for societal and corporate challenges, it offers an enhanced approach. Its integration into community banks exemplifies this. This ensures that, as these institutions are woven into the fabric of their local communities, their internal operations and employee relationships are equally interconnected.